1.

Introduction

Multiparametric magnetic resonance imaging (MPMRI) is

increasingly being recommended for the diagnosis of

clinically significant (CS) prostate cancer, if the initial

biopsy proves negative

[1,2]. An alternative approach is to

begin with MPMRI imaging to inform who needs a biopsy

and, in those who need it, how it might be best conducted

[3] .Recent studies have reported encouraging results on the

performance of MPMRI in detecting CS prostate cancer

[3 – 5] .The Prostate MR Imaging Study (PROMIS) was the largest

accuracy study on the use of MPMRI and transrectal

ultrasound-guided biopsy (TRUSB) in the diagnosis of

prostate cancer

[4] .Using template mapping biopsy (TPMB)

as the reference standard, it was found that MPMRI had

better sensitivity for CS prostate cancer compared with

TRUSB but worse specificity

[4]. It is therefore necessary to

explore how best to combine these tests and the

consequences of incorrect diagnosis on health outcomes.

This study aims to identify the combinations of tests

—

diagnostic strategies

—

that detect the most CS cancers per

pound spent in testing and achieve the maximum health

given their cost to the healthcare service.

2.

Patients and methods

The target population was men at risk of prostate cancer referred to

secondary care for further investigation

[4,6] .The perspective was the

UK National Health Service (NHS). Costs were expressed in pound

sterling from a 2015 price base. The time horizon is the population

’

s

predicted lifetime. Costs incurred and health outcomes attained in the

future were discounted to present values at 3.5% per annum

[7] .2.1.

Diagnostic strategies

The diagnostic strategies consisted of clinically feasible combinations of

MPMRI, TRUSB, and TPMB, in addition to the use of TRUSB and TPMB in

isolation

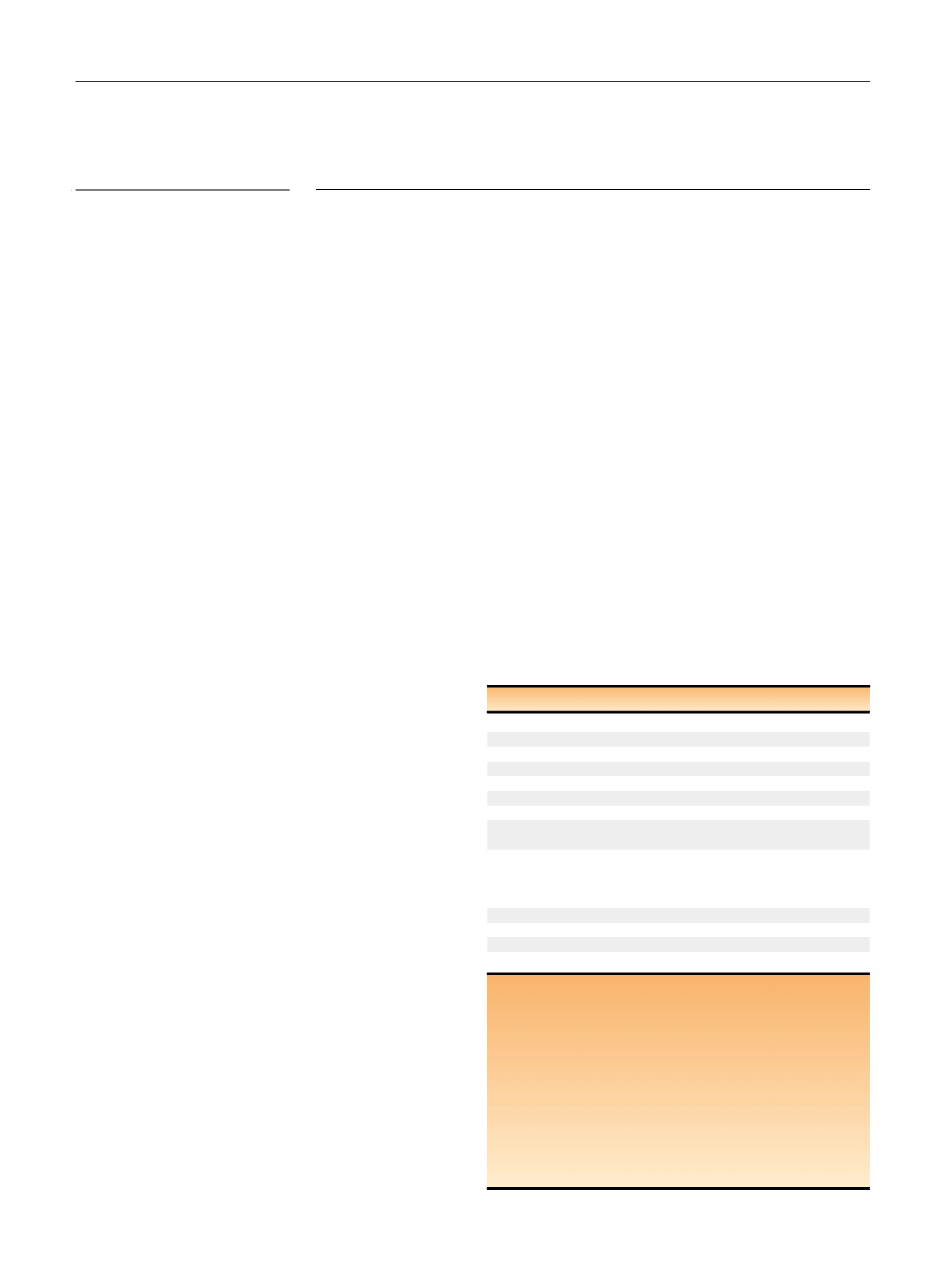

( Table 1; details in the Supplementary material, section 1.1).

These included strategies using MPMRI to decide whether a TRUSB or

TPMB is necessary and target the TRUSB, and strategies starting with

TRUSB and using MPMRI to decide whether a repeat biopsy is warranted.

A diagnosis of CS cancer requires a biopsy, hence strategies were de

fi

ned

to always end with a con

fi

rmatory biopsy. Within each test combination,

there are alternativeways each test can be used, following the de

fi

nitions

used in PROMIS (see

Tables 2 and 3). Each of the 32 test combinations

were tested for the alternative classi

fi

cations and cut-offs, returning a

total of 383 strategies.

2.2.

Model structure

The model had a diagnosis and a long-term component (Supplementary

Fig. 1). For diagnosis, a decision tree combined the information on

diagnostic accuracy of the tests to determine the accuracy of the test

combinations

( Fig. 1). The long-term outcome component calculated the

long-term health outcomes and costs of men with CS cancer, non-CS

cancer, and no cancer, by whether they were correctly diagnosed or

missed. Their diagnosis determined their clinical management, as either

immediate radical treatment if CS cancer is diagnosed or surveillance if

not. The long-term outcome component was a cohort Markov, with two

health states for menwith no cancer (alive and dead) and three states for

men with cancer: localised cancer, metastatic cancer, and death. The

decision model was developed in Microsoft Excel.

2.3.

Diagnostic performance

The model explicitly re

fl

ects the sensitivity and speci

fi

city of TRUSB and

MPMRI in detecting prostate cancer.

Tables 2 and 3show the diagnostic

performance of the tests, calculated from the individual level data

collected in the PROMIS

[4](details in the Supplementary material,

section 2). The men

’

s true disease status was classi

fi

ed in four subgroups,

according to the TPMB results and their serum prostate-speci

fi

c antigen

(PSA) level

[1]:

1. No cancer

2. Low risk: PSA 10 ng/ml and Gleason score 6, who should be

classified as having non-CS cancer

Patient summary:

We found that, under certain assumptions, the use of multiparametric

magnetic resonance imaging

fi

rst and then up to two transrectal ultrasound-guided biopsy

is better than the current clinical standard and is good value for money.

© 2017 European Association of Urology. Published by Elsevier B.V. This is an open access

article under the CC BY license

( http://creativecommons.org/licenses/by/4.0/ ).

Table 1

–

Diagnostic strategies

Test

Strategies

MPMRI

First test

M1

–

M7; N1

–

N7

Second test after TRUSB

T5

–

T9; P5

–

P9

TRUSB

First test

T1

–

T9; P2

–

P9

Repeat TRUSB in men with no cancer detected

T2, T4

Repeat TRUSB in men with non-CS cancer detected T3, T4

Second test after MPMRI: MRI-targeted TRUSB,

in men with lesions visible at the MPMRI

M1

–

M7

Repeat MRI-targeted TRUSB in men with no

previous cancer or non-CS cancer at

fi

rst

MRI-targeted TRUSB, but with lesions visible

at MRI

M3

–

M7; T5

–

T9;

N3

–

N7

TPMB

First test

P1

Second test

P2

–

P4; N1

–

N4

Third test

P5

–

P9; N3

–

N7

MPMRI = multiparametric magnetic resonance imaging; TRUSB = transrectal

ultrasound-guided biopsy; TPMB = template prostate mapping biopsy;

CS = clinically signi

fi

cant. MRI-targeted TRUSB is a TRUSB informed by a

prior MPMRI. All TRUSB post-MPMRI are assumed to be MRI-targeted TRUSB.

Diagnostic strategies were labelled according to their test combination

fi

rst

(M1

–

M7, N1

–

N7, T1

–

T9, P1

–

P9), and then their biopsy TRUSB de

fi

nition (1 or

2), MPMRI de

fi

nition (1 or 2), and cut-off (2 to 5). T strategies start with

TRUSB, M strategies start with MPMRI, P strategies are the same as T

strategies, and N strategies are the same as M strategies but have TPMB as

the last biopsy. For example, strategy M1 125 refers to test combination M1,

in which all men were

fi

rst assessed using MPMRI de

fi

nition 2 and cut-off

5 and then followed up with biopsy de

fi

nition 1 for those with a suspicion of

CS cancer. See the Supplementary material, section 1, for full details on the

test sequences for each diagnostic strategy.

E U R O P E A N U R O L O GY 7 3 ( 2 0 18 ) 2 3

–

3 0

24